Our Future of Britain initiative sets out a policy agenda for governing in the age of AI. This series focuses on how to deliver radical-yet-practical solutions for this new era of invention and innovation – concrete plans to reimagine the state for the 21st century, with technology as the driving force.

Contributors: Jeegar Kakkad (TBI), James Browne (TBI), Laura Britton (TBI)

Chapter 1

Housing is fundamentally about aspiration. It’s about more than just having a roof over one’s head – housing is central to people’s quality of life, their sense of security and belonging to a community, and their freedom to achieve their personal and professional ambitions.

Addressing the nation’s housing problems is therefore not just a narrow question of efficiently allocating people a place to live. It is about giving everyone the opportunity to work and live where they want; it is about delivering enhanced growth and prosperity for the nation; and about improving the quality of life for every person across the country.

This is why housing policy is so central in the British political debate.

Yet, despite all the political attention it gets, the country’s housing sector is delivering worse outcomes for individuals and for the United Kingdom as a whole.

Britain has high and rising[_] housing costs, which puts pressure on the cost of living for individuals and families and makes it hard for younger people to enter the housing market. In the 1990s, it took three years for a low- to middle-income family – at the 30th percentile by income – saving 5 per cent of their disposable income to save enough for a deposit. By 2021–22, this figure had risen to more than 22 years.[_]

The lack of good-quality and affordable housing near key economic centres is also a significant obstacle to creating the deep labour markets of skilled workers that enable high-value, knowledge-based economic clusters – and subsequently foster innovation and growth. Of the 4.3 million new homes added in England and Wales from 2001 to 2023, only 21 per cent were in the 12 towns and cities with the highest average wages.[_]

The new Labour government now has a historic opportunity to deliver the housing the country so desperately needs – plentiful, good-quality homes in the places where people want to work and live, with access to the right infrastructure and public services to form strong communities.

But this will require a bold new approach to housing and planning policy.

Housing policy is an area where much has been promised but little delivered. Continuous promises to address the housing crisis have consistently not been kept. Several attempts to do so have failed or been reversed following backlash. The previous government’s white paper proposing zoning was abandoned after a revolt by backbenchers. Earlier policies on densification were reversed after complaints about “garden grabbing”.[_] New towns have had successes, but have also caused some negative reactions and have not been built at the scale originally envisaged or required to meet housing demand. And non-supply measures such as the previous government’s Help to Buy equity loan scheme and Right to Buy policies have proved controversial while, at best, failing to address fundamental issues of affordability.

These policies are failing to deal with the roots of the problem. The current planning system is holding back progress at every point: it is failing to incentivise building homes where people want to live and work; it is embedding slow, outdated processes; and it is empowering veto players rather than those keen to deliver change.

Rather than translating political will into a system that delivers aspiration, the current system holds back progress at every turn.

The new Labour government can forge a new path. While all the problems in the UK’s housing sector cannot be solved overnight, the government has the opportunity to create lasting and meaningful change, to finally enable the development of a new generation of homes to support economic growth and individual aspiration. These efforts should be accompanied by measures to address failures in the mortgage market and other shortcomings to improve affordability and flexibility for tenants.

The direction of travel set out in the Labour Party’s manifesto and the government’s recent announcements on housing show the determination to act on the entrenched problems that hold back housing today. On affordability, the manifesto promised a new mortgage-guarantee scheme, in line with the recommendation in the TBI paper Bringing It Home: Raising Home Ownership by Reforming Mortgage Finance. Delivering new towns, introducing a new “grey belt” classification, reforming compulsory-purchase compensation rules and increasing the capacity of planning departments are all positive steps that demonstrate real ambition. But more remains to be done to truly grapple with the entrenched issues within the UK’s housing sector.

Various policymakers have set targets for numbers of homes to be built. The previous government aimed to build 300,000 homes per year in England by the mid-2020s. Although the pandemic clearly affected progress, recent performance has significantly undershot the target. The new government has set out a new planning target of 370,000 homes per year. Given the enormous value that can be generated through more homebuilding and lessons from other countries in successful housing delivery, this is definitely deliverable – not only fiscally, but practically and politically. Indeed, there are options to go beyond those numbers through other, non-target-based measures.

This will require a radical-yet-practical agenda.

Rather than creating more complexity and increasing the number of veto points in the system, housing and planning policy should become a platform for rapid, high-quality delivery in a way that is welcomed by communities, taking difficult questions out of local politics. Innovation must be unleashed and the power of artificial intelligence utilised to drive efficiencies and better outcomes.

We need to reimagine the housing and planning systems for the future.

To accelerate the delivery of a new ambitious housing strategy for the UK, the government should take action in three areas:

Plan for more homes in the right places. This will require enhanced focus on building homes where they will be most beneficial, and accelerating processes to deliver the infrastructure and public services needed for communities to flourish.

Enable efficiencies, innovation and the future use of AI by reforming the planning system. This will involve streamlining the system and making it more predictable to increase speed and reduce costs.

Align powers, incentives and veto points in the system. This will empower decision-makers at all levels within the system and reduce the number of blockages, accelerating delivery.

Chapter 2

Britain’s problem with housing is well established. Neither individuals and families nor the UK economy as a whole are getting good outcomes from the housing sector. In many cases, the problems are becoming worse.

The problems in the sector are numerous, interrelated and complex, but broadly speaking they are centred around issues of affordability, quality and location.

Affordability

Perhaps the most visible problem within the UK housing sector today is the high cost associated with buying or renting a home. In fact, housing is becoming increasingly unaffordable both to individuals and to the state.

For individuals, housing costs absorb a larger fraction of household spending in the UK than in any Organisation for Economic Co-operation and Development (OECD) country except Finland.[_] The average house in the UK currently costs around nine times average annual earnings, its highest level since the Victorian era.[_],[_] The increase in house prices relative to incomes between 1985 and 2019 can largely be explained by falling interest rates[_] in the absence of plentiful supply. Immigration has also been a factor in increasing demand.[_] As a result of multiple factors, it has become far harder for people to save up to buy a home. Low- to middle-income households saving 5 per cent of their disposable income per year were able to accumulate the deposit required for an average first-time-buyer home in about three years in the 1990s.[_] By 2021–22, it had risen to more than 22 years.

The time it takes a low- to middle-income household to save for an average deposit has increased rapidly since 1990

Source: ONS, Cambridge Centre for Housing & Planning Research, UK Housing Review, DLUHC (via Statista), HM Land Registry, Halifax Note: Years for an average low- to middle-income (30th percentile) household to save for an average first-time-buyer mortgage deposit (1990 to 2022)

The problem is also manifested in high, increasingly unaffordable rents within both the private-rented sector and for some affordable-housing tenures.

Since the early 1980s, rents in both private- and social-rented housing have risen well above the level of earlier decades as a proportion of tenants’ incomes. Currently, private-sector rents are increasing rapidly, far faster than wage growth. Average UK private rents increased by 9 per cent in the 12 months to February 2024, the highest annual percentage change since this UK data series began in January 2015.[_] The Resolution Foundation expects that average rents could increase by 13 per cent over the next three years as current high growth in the private-rental market works its way through existing tenancies.[_]

The affordability problem is most acute for those on the lowest incomes.[_] In 2022 Britain spent £23.4 billion on housing benefit – more as a fraction of national output than any other OECD country[_] – but housing subsidies have still failed to maintain their share of total housing costs, as outlined in recent TBI commentary Subsidising Subsidies: The Real Cause of Falling Housing Affordability? Shortfalls between rent and housing support have grown over time as housing costs have increased.

Many families have to use other sources of income to make up their rent, squeezing budgets for essentials such as food and energy. Some also turn to their local authority to bridge the gap, through discretionary housing payments (the budget for these has declined from £180 million in 2013–14, to £100 million in 2023–24) and other forms of crisis support.[_] There are more than 1.2 million households on council-housing waiting lists. This number would be much higher but for the many who are ineligible or do not bother to apply because they think they will never get a council home. This is pushing more people into the private-rented sector.

Lack of affordable housing is also strongly correlated with higher degrees of homelessness.[_] Homelessness is a worsening problem in Britain today, with significant negative consequences. It impacts individuals’ physical and mental health, increases vulnerability to violence and exploitation, and impedes access to employment and education. It also puts significant strain on local-authority resources. Councils spent £1.7 billion on temporary accommodation in 2022–23, up by 9 per cent on 2021–22.[_] There is strong public concern at rising levels of homelessness and a desire for government action.[_] The housing-benefit subsidy that councils receive when they house a family in temporary accommodation was set at 90 per cent of the applicable local housing allowance rate in 2011 and has remained frozen since.[_] This can cost councils hundreds of pounds per resident per week.

Quality

Rising costs are not a reflection of improved housing stock or people having more room. England has less residential floorspace per person than Japan, France, Germany, Taiwan, Denmark and the United States.[_] British housing is also the oldest housing stock in Europe,[_] with poor insulation,[_] overcrowding,[_] poor internal layouts,[_] and low-quality or unsafe construction.[_] British homes lose heat three times faster than German homes, at a huge cost to residents.[_]

The total price of UK housing is four times the value of the structures that form those homes.[_] In many of the UK’s cities, home prices are considerably higher than the construction cost (excluding land) of building new homes.

Construction costs and sale prices of flats

This represents a big economic inefficiency. Basic economic theory would imply that if there is a plentiful supply of homes and no tight geographic constraints, the prices of homes tend not to rise much above the economic cost of building more homes, as happens in some areas of other countries.[_] While we would generally expect rents and house prices to be higher in the centre of a city than on the outskirts due to agglomeration effects, the time and cost implications of travelling inwards, and the higher marginal costs of adding higher floors, there is the potential to unlock significant economic value by allowing more homebuilding in and around these cities.

The British public is increasingly experiencing worse outcomes while paying more.

Location

The housing crisis is not felt in the same way across the whole country. Affordability problems are more acute in areas of higher productivity. This is because the availability of homes fundamentally does not match the social and economic needs of the country.

Both home prices and rents are highest and most unaffordable in the areas of the country with highest productivity. In April 2024 the average monthly rent for a two-bedroom flat in Hackney in London was £2,138 – more than four times that in Dumfries and Galloway.[_] The average flat in Cambridge sold for £312,000, three times the cost of an average flat in Wrexham.[_]

The effects of this can be seen in reduced labour-market dynamism. In 2018, young private renters were one-third as likely to move job and home as 20 years before.[_] This reduction in labour-market dynamism is harming productivity growth[_] as workers stay in less-productive jobs for longer.[_] Ultimately, this also limits the freedom of individuals – people cannot live and work where they want.

A large reason for this is that most new homes have not been built in and around cities and economic centres where they would deliver the greatest economic opportunity by providing access to good jobs and the most additional tax revenue to improve public services. Of the 4.3 million new homes added in England and Wales in 2001 to 2023, only 21 per cent were in the 12 cities with the highest average wages.[_]

This is one reason why UK cities have lower housing density than comparable French and German cities.[_] Paris, Madrid and Milan all have areas that are more than twice as dense as the densest part of London.

The low housing densities of English cities have made the situation even more challenging by limiting the viability of good public transport,[_] as has the lack of a fair system of paying for roads, which would reduce congestion, as explored in the TBI paper Avoiding Gridlock Britain. Greater Manchester, with a population 600,000 greater than Hamburg, has 300,000 fewer residents within a 30-minute commute of the city centre.[_] Only 38 per cent of Leeds residents can reach the city centre in 30 minutes; the proportion in similarly populated Marseille is 87 per cent.[_]

The lack of affordable housing that people want to live in is a key obstacle to creating the deep labour markets of skilled workers that enable high-value, knowledge-based economic clusters, and foster innovation and growth.[_]

The result is unfulfilled aspiration and worse socioeconomic outcomes. Today, the opportunity for people to have a decent home in the area where they want to live and work – whether owning or renting – is unachievable for many. The results are visible across society: worse physical and mental health outcomes, reduced family stability as more families are forced into insecure rental tenures with increasing rents, and lost economic growth and opportunities to harness agglomeration effects. Ultimately, this is eroding the sense of security, possibility and optimism that drives progress.

The current situation is not sustainable. The shortage of good, well-connected homes harms the whole country. Rather than being a zero-sum game where some necessarily lose when others gain, fixing Britain’s housing problem could create enormous social and economic value.

Chapter 3

The UK needs a fresh strategy that turns it from being a country where housing is a problem into one where housing is a driver of positive social and economic outcomes.

The problems with the UK housing sector cannot be fixed overnight. The issues are deep-rooted and have developed over decades. Previous attempts at solving them have consistently failed.

However, we know and understand the levers to resolve them.

The UK has not built enough homes in the right places and of the right quality to keep up with rising demand in those locations for many years. Most of the stock is old and built to the much lower standards of the past. Some of it is long past its design life. And buyers must economise on quality in order to cover the large portion of the average home price that is eaten up by the price of land that has planning permission.

Building new homes in areas of high demand should help to stop housing becoming more unaffordable. At sufficient scale and over time, it can also help make housing more affordable overall.[_]

Consider a new home sold to parents with a newborn second child. They sell their previous home to a first-time-buyer couple with a baby. In turn, that couple’s former rental flat becomes available for other renters, increasing the choice available and the competition among landlords to find a tenant, which decreases upward pressures on rents. That will in turn help reduce the overall bill for housing benefit and temporary accommodation, meaning less money is wasted on expensive private rentals and more can be spent on investing to build affordable housing. The “moving chain” outlined above will also give each of the occupants more living space and help to reduce overcrowding at the lower end.

But if the new home purchased by the parents who have recently welcomed their second child doesn’t get built they face a situation of competing with similar families for a smaller number of homes. With a larger number of bidders on the available homes, the couple may find they are priced out of the market or simply cannot find a suitable property, meaning their property chain never starts moving: the first-time buyer couple with a baby is unable to buy their previous flat, and that couple’s rental flat doesn’t become available to new tenants. As these trends are repeated across the market there is less and less movement overall, driving up competition for a smaller number of available homes – both to buy and to rent – and thus driving up prices.

One common complaint is that new homes built by developers are purchased by absentee owners who leave their properties empty, thus contributing to the scarcity of places for people to live. However, the role of vacant homes is often overestimated. In a few parts of central London, a significant portion of new homes are held vacant by speculators.[_] Specific areas would be to amend property taxes to address the question of vacant homes.

There are practical examples of homebuilding helping to improve affordability. In 2016, Auckland, New Zealand, amended its planning rules to allow three times more homes on three-quarters of residential land. For those areas, the number of permits issued annually increased by more than tenfold in five years.[_] Since 2016, rent-to-income ratios have risen much less in Auckland than elsewhere in New Zealand.[_] Rents are an estimated 26 to 33 per cent lower than they would have been without the upzoning.[_]

Upzoning in Auckland spurred a surge in high-density housebuilding

New dwelling approvals in Auckland per 1,000 people (rolling 1-year average)

Source: John Burn-Murdoch, Financial Times

Auckland’s upzoning slowed rent rises, erasing a 25 per cent premium compared to Wellington

Nominal median monthly rents, seasonally adjusted in New Zealand dollars

Source: John Burn-Murdoch, Financial Times

Upzoning also led to inflation-adjusted rent stabilisation

Real-terms change in median rents in Auckland and Wellington in 2016, New Zealand dollars

Source: John Burn-Murdoch, Financial Times

In Atlanta, a US city with a highly responsive supply of new homes, prices tend not to rise much above the minimum profitable production cost of building a new home, even as the population has grown. By comparison, in San Francisco, which has a highly inelastic supply, prices have remained far above that level.[_] Similarly in Houston, which allowed more homes per acre through an opt-out process, house prices have not climbed as much as in other US cities.[_]

Building new homes where people want to live and work can also help boost economic growth and create effective clusters for growth and innovation around the country.

Imagine a new home built in an existing settlement, well connected to good jobs. A young person may choose to rent it for their first well-paid job or to stay in it while training. Even a new home for a mid-life buyer can help a young person through the moving chain described above. Those early career opportunities to learn, develop skills and build a network are a critical part of ensuring that every young person can reach their highest potential. Without sufficient new homes in the right places, many people cannot access these opportunities. New homes will also allow the most productive firms to hire new employees and grow. Some of those young people will in turn go on to set up their own companies, perhaps starting or adding to clusters elsewhere in the country.

Economists Gilles Duranton and Diego Puga estimate that a less restrictive regime to allow more homes in just seven US cities would raise output per person by 7.95 per cent.[_]

Despite this evidence, instead of building more homes, the UK has built fewer. The annual percentage rate of net growth in the housing stock in England and Wales peaked in 1934 at 3.08 per cent.[_]

Estimated increase in housing stock per decade, showing the underperformance in recent decades

Source: Holmans, ONS

There is a chronic lack of places where new homes have been planned for – through both better use of land in existing settlements and new sites for homes being made available in the right places. Tight supply of places where permission can be granted for new homes, combined with long and expensive processes for development, drive up land values, while the costs and delays involved in constructing new homes drive up the prices of new homes and restrict supply.

As a result, the UK now has the most expensive land for housing and the least investment in residential buildings per capita of any country where data are available apart from Japan and Mexico. Land[_] now accounts for three-quarters of the total value of UK housing and the buildings only one-quarter – down from 44 per cent in 1995.[_] To put it another way, the overall price of the UK’s housing stock is currently four times what it would cost to construct equivalent homes today. This difference – between the cost of building more housing and the value when built – represents an enormous opportunity to create social and economic value by building more homes.

Homes in the UK are cheap to build, but land for building is expensive

Value of homes (structures) and land underlying homes (incl. permissions) per capita, 2021

Source: World Inequality Database (national housing assets). Note: Prices adjusted for purchasing power parity in 2022 US dollars

The UK has fallen behind in housing quality as land for building has become more expensive

Average housing wealth per capita

Source: World Inequality Database, national housing assets (downloaded 3 June 2024) Note: Prices adjusted for purchasing power parity in 2022 US dollars

The shortage of development sites is not due to a lack of space. Land where no building is permitted is relatively inexpensive and plentiful, both in and around cities.[_] And there is plenty of scope to make better use of existing urban land. For example, delivering the housing density of London’s leafy and prosperous Maida Vale across the city could theoretically add 7 million new homes. Similarly, a release of just 3 per cent of the green belt around London for homes at that same density would create space for 3 million new homes.

The problem rather lies structurally within the way the government plans and incentivises development of new homes.

Britain should embark on an ambitious strategy for building more homes in areas where they will deliver the most value to individuals and to the economy.

The government should use three main approaches to increase housing supply: 1. build new towns in strategic locations across the country; 2. build a new generation of social housing; and 3. enable gentle density in cities.

Building New Towns and Urban Extensions

Developing completely new settlements, or “new towns”, can be an effective way of adding a large number of new homes and creating new opportunities.

There are many successful examples of this. In the 1960s, the Paris region master plan created five new towns around the city that now hold 850,000 people and make up about 7.7 per cent of Greater Paris’s economy.[_] Sweden’s Million Programme, implemented between 1965 and 1974, achieved the ambitious goal of building 1 million homes at a time when the nation had a population of 8 million.[_]

Britain created a number of successful new towns from the 1940s to the 1960s, along with some that were less successful, from which valuable lessons can be drawn. But in the past few decades, the UK has built little in the way of new towns. Now there is an opportunity to change that.

When embarking upon a strategy of building new towns it is important to be aware of the constraints. It will take time to grow state capacity to deliver them at scale, and so the number of initial sites will be limited. That means it is key to be strategic in choosing sites that will deliver the kind of communities the country needs and that will most benefit the country as a whole in terms of jobs, growth and more affordable homes.

For new towns to thrive and be attractive places where people want to live, it is essential that they have good access to jobs and services as well as good infrastructure. When designating sites, the government should consider how to make best use of existing infrastructure and amenities as much as possible to reduce upfront costs. To pay for additional infrastructure investment that will allow the settlement to thrive, new towns should be located where high land prices mean that large amounts of value capture is possible.

This means, as the government has announced, a new generation of new towns should largely take the form of urban extensions, such as Edinburgh New Town, Leamington Spa, central Harrogate or Barcelona’s Eixample. There is excellent potential for green, walkable urban extensions with good public-transport links to some of the country’s most unaffordable cities, such as York or Oxford.

Urban extensions require less additional infrastructure than separate new settlements and can generally be developed more quickly. They also benefit from easy access to all the amenities of the existing city from day one. Urban extension and urban infill are how most homes have historically been delivered.

The easiest opportunities for entirely new settlements arise where existing transport links have spare capacity. As for entirely new settlements, the most attractive opportunities are where there is already good transport and other infrastructure, such as on the West Coast Main Line south of Birmingham, along the Elizabeth line, on the future rail link between Oxford and Cambridge, or on the London to Brighton line with some investment at Croydon.

Building a New Generation of Social Housing

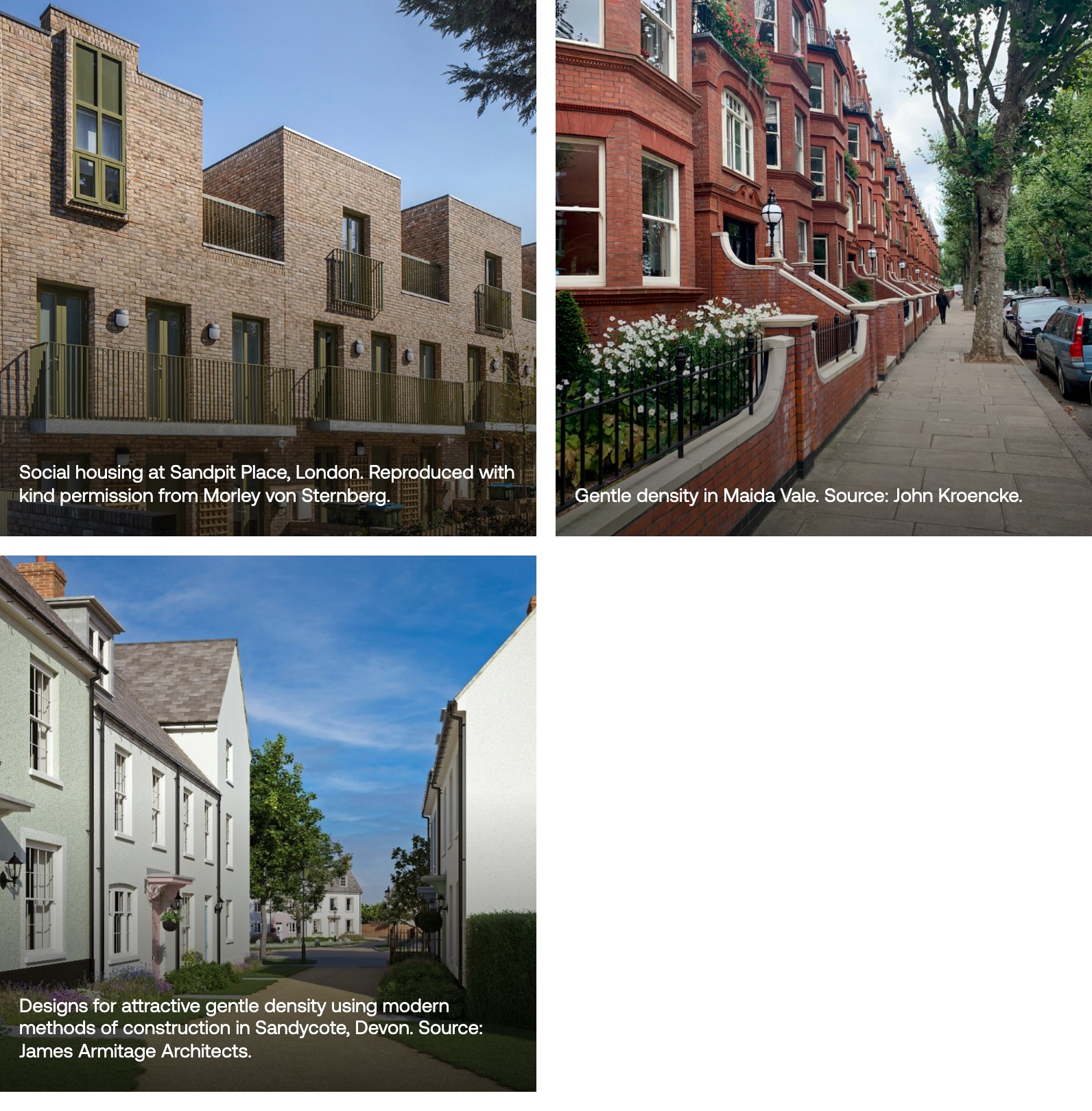

The housing crisis is felt most acutely by those on low incomes. Many people, particularly those with complex needs, benefit from the additional security and support of social housing.[_] To help address those needs, the government should launch a programme for 700,000 new council homes, as recommended by TBI experts in Subsiding Subsidies: The Real Cause of Falling Housing Affordability? In the 1960s, 1.24 million social homes were built, compared to 150,000 in the 2010s. Social homes are more stable than private renting; tenancies are secure, giving social tenants stronger rights and greater protection from eviction. Building social homes without substantial land costs – for example through the purchase of land at agricultural value or building net new social homes through renewal of existing estates – can substantially reduce bills for temporary accommodation and housing benefit and improve health and social outcomes. Where social homes provide true additionality – that is, where market homes would not be built in their place – the overall economic gains from building more social homes can be enormous. (See images above.)

Building new social housing has suffered from fiscal limits. However, many of the new social homes that Britain needs could be built at minimal net cost to the Treasury through value capture in new towns.

The integration of council homes in new towns presents exciting opportunities to create well-integrated, tenure-blind communities. Given the limited resources in the Ministry of Housing, Communities and Local Government and within Homes England, the greatest number of new social homes will be generated through new towns and renewal in areas where the most land value can be captured, due to the existing shortages of homes. For example, an urban extension of Oxford could generate one new social home for every market home delivered. At walkable densities, adding an area one-eighth of the size of Abingdon, an existing town close to Oxford, could provide 10,000 new council homes. In total, across areas of high land value around the country there is scope to fund more than 2 million new council homes through value capture.

There is also the potential to do more within fiscal constraints in existing towns and cities with the most unaffordable housing. For instance, successful Labour policy in London requires as a condition of grant funding that any estate renewal must win majority approval in a ballot of residents. Those ballots have demonstrated strong tenant support for estate renewal that delivers greener, better homes to existing tenants[_] while adding more council homes. This renewal is funded through value capture by building private housing for sale or rent and retrofitting existing homes to modern standards.[_] There are many examples of such renewal working well in other countries, including in the city of Toronto in Canada.[_] Of course, this kind of funding will only be possible for estate renewal in the most expensive places. A full renewal of all social stock will require considerably more funding when the fiscal position allows.

Making Value Capture Work

Because of the unprecedentedly large difference in some parts of the country between the price of a home and the cost of building that home, granting planning permission can unlock enormous value. In addition to signalling a housing shortage, high land values furnish a means to fund infrastructure and more social housing. Making land available to build new settlements and urban extensions is therefore not just strategic for adding to the housing stock, but also offers an opportunity for local authorities to finance wider priorities.

Different countries have a range of different methods to harness a share of that value. They also have ways to capture some of the increase in the value of existing buildings generated by new transport and other infrastructure. Those methods are generally referred to as mechanisms for land-value capture. They include:

Periodic property taxes calculated as a percentage of the value of the property or the land

Payments in cash or in kind by a developer

Purchase of the land at or near its value in existing use and resale of the land with permissions and new access infrastructure (roads, utilities) or of developed buildings

Charges on the uplift in value of existing buildings due to new transport (known as “transport premium charges”)

Other taxes that are not specifically targeted at land-value uplift, including tourism taxes, parking charges and road-pricing schemes

Currently, the UK’s primary method, known as “section 106 agreements”,[_] creates uncertain, lengthy and expensive arguments about what level of payment would make the development unviable. Wherever possible they should be replaced with a simpler mechanism. It is also important to acknowledge the trade-offs in these mechanisms. In particular, where costly investment is needed to make a site ready or where planning policy is not the binding limit on the number of homes that can be built, such requirements can result in an overall reduction in new homes.[_] An inflexible requirement for affordable homes to make up a certain percentage of the homes in a given development can mean fewer affordable and market homes being built in total. Care is needed to ensure that such requirements do not harm housing delivery.

To enable the provision of required infrastructure and new social homes through value capture, new towns should be sited where housing is most scarce – that is where land values are, or potentially could be, highest. This will enable land-value capture to help fund new social homes and the necessary infrastructure for the new settlement, although that will generally require borrowing against the future market homes to be built.

Prioritising Greater Gentle Density in Cities

In addition to urban extensions and social housing, it is also important to continue to build more market homes in cities to improve affordability and housing options.

Building more homes in existing settlements through “gentle density”, with mid-rise buildings such as terraced houses and mansion blocks (see images above), is good for the environment, for social welfare and for economic growth. Increasing housing density in cities helps the environment and social outcomes by adding homes in areas well served by existing public transport and other infrastructure.[_] It also allows new residents immediate access to all the amenities of the existing settlement from day one.[_] This helps avoid the problems that can be found in isolated satellite sites like Northstowe in Cambridgeshire. Increasing density will also reduce carbon emissions through greater use of public transport[_] and more walking and cycling.[_]

Creating more homes near jobs will reduce average commute times and give more workers access to better economic opportunities.[_] Infill development can therefore often deliver the largest agglomeration effects. A new home within an existing large settlement allows the rest of that settlement to be reached in a much shorter time than a remote site. That drives greater benefits in terms of working and cooperating with other people. Because land values are driven in large part by access to opportunities and amenities, each home added in an area of high land value creates the most economic value and additional growth.

Building more homes in existing cities is also good politics. Many young people want to live in a city for the first part of their career – for training, good jobs, and the personal and professional relationships they will build.[_] Many know that they are unlikely ever to qualify for a council home. Government housing strategy must give them hope by improving their options in the private market.

There is understandable concern about the politics of gentle densification because of unnecessary challenges caused by dysfunction in the current system. While densification through the current system can be locally unpopular, it does not have to be. There are numerous real-world examples of popular, win-win densification that has been delivered in a variety of ways, both in the UK and overseas.[_] As with other ways to build homes, it is important to aim for the biggest impact at the lowest political cost. Many previous reforms have foundered for neglecting that principle.

Infill also allows faster delivery of housing as a supplement to other approaches. Infill development can be more rapid because it generally does not require extensive infrastructure in advance and multiple independent developments can proceed all at once. Different landowners are forced to compete, rather than drip-feed development to meet demand as is often seen on large sites. Infill in cities or large towns rather than in isolated sites can also tap a wider range of potential buyers. That means a higher absorption rate, which subsequently funds faster buildout.

Greater gentle urban density comes with many advantages. However, current planning policy and incentives are holding back these opportunities and making it too hard to plan for proposed developments that would deliver gentle density – even those that are widely supported.

A New Generation of Homes

The economic value that could be generated by adding more homes in the areas of highest housing need, near to good jobs – the difference between the prices of homes and the economic cost of building them with necessary infrastructure – has risen substantially.

Of course, it takes years to train additional bricklayers, roofers, carpenters, plumbers and electricians. But not decades. And these are skilled, well-paid jobs. In a well-functioning housing system, wages would rise in those trades, companies would train more people and workers could move from lower-paid wages in declining sectors. Better planning would also allow much more efficient modular construction, which would allow each worker to be more productive.

There are also infrastructure constraints – particularly in relation to reservoirs and power supplies – which must be addressed swiftly. But we used to build infrastructure far more quickly. We can again. And infill development is a key way to make best use of existing infrastructure.

The main constraints on homebuilding are political: the political incentives for politicians to support new developments are very often outweighed by the political costs of displeasing existing constituents. But the time has come to address that balance and to start being much more ambitious as a nation. The measures set out here could dramatically increase the rate of development, well beyond 370,000 a year, potentially delivering more new homes per year than ever before.

Chapter 4

Previous attempts to solve Britain’s housing problems have been piecemeal, sticking-plaster solutions that have often resulted in worse, rather than better outcomes. The government should devise new ways of addressing this pressing issue. Achieving the lasting reforms and changes required to fix the UK’s housing sector requires a radical-yet-practical plan – one that engages with the problems as they are and seeks to create lasting structural reforms to correct them.

Aided by AI-era tools and the opportunities presented by new devolution deals across the country, Britain has the opportunity to completely redesign its housing and planning systems for the future, making the government a platform for delivering the plentiful, high-quality housing the country needs. Reimagining the planning system will create a framework that allows for much more diversity and flexibility, which will encourage more innovation and competition.

Such a strategy is achievable – financially and politically. But it will require bold action and the courage to try new solutions and face entrenched opposition.

To reimagine the UK’s housing and planning system for the future, the government, working in cooperation with the devolved administrations, needs to take action in three core areas:

Plan for more homes in the right places

Enable efficiencies, innovation and the future use of AI

Align powers, incentives and veto points to deliver more homes

Plan for More Homes in the Right Places

The development of a new generation of homes will require better strategic, integrated long-term planning from the government. This is necessary to ensure homes are prioritised in areas where they will provide the most value to individuals and society as a whole by driving economic growth, and to ensure the local infrastructure is in place to support these developments.

There are three policy areas where the central government could create the foundations for a more strategic approach to development.

First, to deliver the requisite new urban extensions, the government will need to strategically designate areas for development. These areas must be well connected, contain all necessary infrastructure and be located where they can maximise overall economic and social benefits.

Designating these areas may be politically fraught – many potential sites with the highest land values are likely to have strong local opposition to new homes. This will require the government to choose sites that deliver the maximum benefit without risking political capital.

New towns have become more politically contested, litigation-prone and slower over time, as levels of home ownership have increased. At the current rate at which the Ebbsfleet new town is being built (approximately 600 homes a year), it would take 500 Ebbsfleets to meet a national annual target of 300,000 homes. Environmental Impact Assessments (EIAs) will need to be written after preliminary selection of designated new-town sites. If the initial selection takes 12 months, it could take a total of two years before a final decision is made and any necessary compulsory-purchase proceedings started.

Those compulsory purchases must then survive potential judicial review before contractors can be mobilised to start construction of infrastructure. At minimum water, power, sewage and roads must all be in place before any homes are occupied. To shorten what might otherwise be a timeframe of many years, the government should act decisively at pace and upgrade statutory powers where needed.

To deliver better strategic planning, the government should:

Allocate high-priority national sites for development. For efficient selection of sites – taking into account factors such as housing need, transport requirements, public-service provision and wider environmental concerns – the government should integrate different data sets and utilise satellite data to gain a good understanding of opportunities and constraints. AI-enabled tools can then be utilised to evaluate and optimise the locations and design the rules that apply to the sites. Priority should be given to urban extensions of existing settlements where buildout can be fastest and create most value.

Create new-town development corporations to capture land value that can fund infrastructure and social housing. Development corporations can capture value to fund infrastructure by acquiring land through compulsory purchase at existing-use value through the powers in the Levelling-Up and Regeneration Act and then delegating development or selling the provisioned land for development. Where there are cooperative landowners willing to commit to rapid buildout, time could be saved by using other powers such as strategic development orders, coupled with value capture through tax or other means.

Second, the government needs to improve the incentives in the system to ensure they prioritise the areas where housing is needed. Currently, the main tool directing where housing is built is mandatory housing targets.

To the extent possible, housing targets should be focused on places where they will have the most impact. Targets should be informed by economic and environmental factors to ensure that more homes are built where they will deliver the most economic and social benefit. Areas with the best access to good jobs and highest floorspace values should be allocated the bulk of the target numbers. The government’s proposed new targets take an important step in this direction.

To realign the underlying incentives in the system the government should:

Prioritise homebuilding in areas with the highest housing need by continuing to work to align mandatory housing targets with economic impact and need. This is most easily identified through elevated prices of land for development and other data gathered through AI and satellite technology.[_]

Ensure that policy on industrial land in London and other unaffordable areas is well targeted. Where the economic costs do not exceed the benefits in areas close to transport links with an employment rate above the national average, policy should allow the majority owners of the land in an industrial location to apply jointly for residential uses.

Finally, the government needs to provide the conditions for the right infrastructure to be developed alongside new homes. New homes cannot be added without the requisite infrastructure. But this ingredient is often lacking. The UK has some of the lowest water-storage levels in Europe, yet it has not completed a new potable-water reservoir since 1992.[_] Similarly, electricity infrastructure has not kept pace with growth. New developments in some parts of the UK face potential delays of up to four years due to lack of capacity.[_] TBI has previously written about this problem in Building the Future of Britain: A New Model for National-Infrastructure Planning. In addition, many developments do not provide the necessary amenities, such as health facilities, in time for new residents.

To do this the government should:

Ensure new infrastructure is delivered on time through reforms to the Nationally Significant Infrastructure Project regime. The government can ensure that the right infrastructure is delivered on time to meet the need for new homes by giving “critical national priority” status to investment in trams, rail, reservoirs and grid. Planning ambiguity can be reduced through annual updates of National Planning Statements. Rolling community consultation and EIAs into National Planning Statements approved by Parliament would also reduce the need for lengthy consultations for each project, as previously proposed by TBI.

Prioritise the building of new reservoirs. This is primarily a matter of regulation, ensuring the Water Services Regulation Authority is empowered to incentivise water companies to build new facilities and that the public sector supports this where necessary, including potentially through compulsory-purchase powers.

Set up a new body for public consultation on major projects to streamline infrastructure. This could follow the example of the effective French model, the Commission Nationale du Débat Public, which focuses on major and contentious infrastructure projects. It convenes a discussion process for six months to refine each project so it is more acceptable to communities before the project is planned in detail. This gives clarity and reduces legal challenges. This model has delivered broader consensus at an annual cost of only around £3.5 million.[_]

Enable Efficiencies, Innovation and the Future Use of AI by Reforming the Planning System

The current UK planning system is inefficient and slow, driving up costs and delivering worse, more unpredictable outcomes compared to most other countries. The system requires radical reform to improve efficiency and enable innovation.

Currently, many permissions are driven by expensive and slow judicial or quasi-judicial procedures. Regulations and judicial review often have an unhelpful focus on processes that do not ensure the right outcomes, rather than on protections that would do so.

This has the effect of blocking development and driving up costs for new developments, as well as adding strain to local planning departments.

At present, just one in five major planning applications in England is decided within the 13-week statutory period. The backlog has led to an increase in costs for many builders, with half of small and medium-sized builders saying the cost of obtaining permission has risen by more than 30 per cent since 2021. But developers are far less likely to bother making an application where they are unlikely to get planning permission,[_] so the true extent of the housing problem is vastly deeper than the planning backlog alone suggests.

The response of previous governments has been to tinker around the edges of these problems. Recent moves to fund more planners should add additional capacity to local planning departments. While this is welcome and useful in the short term, it is not fixing the root of the problem.

To truly turn the corner, the government should streamline planning and construction of new homes, making planning rules clear and predictable wherever possible. The lack of predictable rules is largely responsible for lengthy, costly and uncertain processes, which in turn reduce supply.[_]

It is also holding the UK back from integrating AI and data in the planning system to improve the speed of decision-making and the ability to engage communities in more meaningful ways using modern technologies. Numerous examples are emerging that show how AI can be applied in the planning system to improve efficiency. In Kelowna in Canada, the local government has partnered with Microsoft to integrate AI in its planning department to automate the planning-application process.[_] The AI system can receive applications for construction and renovations, analyse them for compliance, and issue permits, including delivering zoning and permitting information to applicants, thus freeing up planning-department capacity.

Increased use of AI requires bright-line planning rules that do not require political judgment to apply. England does have some limited “zonal” regimes with predictable, non-discretionary rules, but they are generally little used or have the effect of blocking new homes. One exception is the national system of permitted development rights introduced under Prime Minister Clement Attlee, which set out categories of development for which planning permission is not required. A new power for the secretary of state to set National Development Management Policies (NDMPs) would also allow more predictable rules. However, the most substantial attempt to move nationally to a zonal system met strong cross-party opposition and was abandoned.[_] It is therefore essential that moves to a more predictable system involve an alignment of powers and incentives, as recommended below.

In addition to streamlining the planning system, the government should review other measures to make sure the planning system supports better and faster decision-making.

To create predictable and streamlined rules, the government should:

Clarify, streamline and simplify planning rules. This could include introducing Environmental Outcomes Reports to replace the EIA regime and setting predictable rules instead of discretionary policies to be weighed against each other. Setting bright-line predictable rules will, over time, enable greater use of AI to automate services and triage planning applications. This could involve instantly approving applications that meet requirements, providing clear, simple measures of redress for applications that fail, and involving planning staff for more complicated applications.

Simplify building regulations. This would make it easier to comply with minimum requirements and enable better use of digital tools and AI to design and assess quality.

Set national policy requiring local plans to move towards clear, precise and unambiguous planning rules. These should facilitate the use of technology to show local people what a proposed plan physically means. Clearer rules and better data will make it far easier for local councils to meaningfully engage local communities.

Set common national standards through NDMPs. These centrally set “general” development-control policies were introduced in the Levelling-Up and Regeneration Act and apply in all areas. They can overcome, for example, the problem of hundreds of different areas having different policies on carbon emissions. Wherever appropriate, they should encourage modern methods of construction, which can deliver high standards.

Ensure that decisions on smaller sites are decided by planning officers in line with the local development plan. Fewer applications should need to be taken to the full planning committee.

Set time limits for statutory consultees and impose a moratorium on the creation of new statutory consultees. After the time limit expires, their approval should be assumed.

Fix the “one-stop shop” for major infrastructure by amending section 150 of the Planning Act 2008 so decisions are made solely by the secretary of state with due regard to the advice of statutory bodies. This would avoid the requirement for multiple consents.

Consider allowing developers to pay for faster decisions and requiring decisions from local planning authorities to be delivered within deadlines that are enforced by penalties. Consideration should also be given to creating a default permission to build, with automatic permission for any complete applications that have not been decided after six months. A pilot could be valuable to ensure that it does not encourage planning authorities to refuse applications one day before the deadline.

Remove or raise the limits on homes that can be delivered through Development Consent Orders (DCOs) and direct that the DCO regime can be used for housing. The government has recently proposed the former, and should add the latter.

Align Powers, Incentives and Veto Points to Deliver More Homes

To further accelerate the pace of decision-making, the government should reduce the number of veto points and ambiguity in the system.

Many of the obstacles and uncertainties above have arisen or survived for so long due to the wrong incentives. Because the system provides insufficient incentives to plan for more homes, there is political demand for rules to obstruct housing. To fix this once and for all, the government must address the more fundamental issues.

The incentives within the system do not adequately drive homebuilding. Financially, it is the central government – not local governments – that receives most of the fiscal benefits of building homes, particularly in high-wage areas. In countries like Switzerland, for example, local governments have strong fiscal incentives to allow more homes.[_] Lack of fiscal incentives for local governments in the UK means they are less likely to prioritise planning for more homes.

This structural problem is further worsened by politics. Even where the current system does allow local governments to capture more benefits from development, such as through building more on land they already own, substantial potential is often left untapped.[_] In interviews, councillors report concerns that those who object to development will vote them out of office, as has often happened.[_] Even where proposals could win overwhelming community support, small unrepresentative groups of objectors are often given a disproportionate voice to block them.[_]

Having the right incentives is critical because of the political strength of opposition to development of nearby new homes. At a national level, 68 per cent of the voters who reported voting in the 2019 general election owned their own home.[_] Swing voters in marginal seats are more likely to be older and homeowners,[_] and homeowners are more likely to oppose building than other residents. England is also more densely populated than most OECD countries and the slow rate of homebuilding over recent decades has left many voters unused to large-scale development near them. These factors make it particularly important to focus on how to sustainably overcome the political challenges.[_]

A fundamental reorganisation is required. The government should go back to first principles to ensure that, at every level, the power to develop is aligned with the incentives, to make sure that the system empowers and drives the right behaviours. This will involve a careful balancing act. When devolving powers, the government should take care not to create unintended additional blocks and obstacles to improving housing outcomes. Instead of devolving powers to obstruct, it should devolve additional powers to permit and facilitate more homes.

There are broadly three areas of action: devolving powers to metro mayors, better aligning incentives for local authorities, and empowering individuals and housing communities around the country.

First, the introduction of new metro mayors opens up new opportunities for local champions who understand their communities and who can drive housing development in areas that will have the most significant impact and support local growth and needs.

The secretary of state already has extensive powers to enable more development in specific areas. These include development corporations, call-in powers, special-development orders, listed-building consent orders and permitted-development rights. Wherever appropriate, such powers to allow more development should be given to mayors as well, without creating another veto layer of general planning policies that might block a local council from approving homes, as elements of The London Plan have done. These powers should include the ability to designate growth areas to allow more development – for example urban regeneration or urban extensions.

Nine of England’s 25 largest urban areas have no devolution settlement in place,[_] yet many towns and smaller cities would also benefit from devolution. Few mayors have powers to fund new infrastructure by capturing from surrounding land a share of the value that the new infrastructure creates.[_] This can have substantial potential, particularly in areas where housing is most unaffordable.

Transport-premium charges have the greatest potential for mayors to capture value created through public investment in transport, via a charge on the increase to property value resulting from new stations. This charge on properties in close proximity to new stations could be made subject to local referendum and deferred to any transfer of ownership.[_]

In addition to the lack of resources under the control of mayors, a major obstacle to more infrastructure has been the possibility of veto at multiple levels. It is impossible for locally mandated political leaders to plan properly for long-term, cost-efficient investment when a subsequently elected national government can cancel or modify[_] the whole project. The Leeds tram is on its third iteration of planning following earlier central-government cancellations in 2004[_] and in 2016.[_] Mayoral powers for business-rate supplements and transport-premium charges should be legally capped so they may not exceed the value conferred on each property by the new infrastructure, but the national government should not have a power to block a local infrastructure project or the use of such localised, light-touch fiscal powers.

The government should:

Devolve powers to metro mayors to allow more development without creating another veto layer of general planning policies that might block a local council from approving homes. These powers should include the ability to grant Transport and Works Act orders[_] and to designate growth areas to allow more development – for example, areas appropriate for high-rise clusters, urban regeneration or urban extensions.

Pass an act to give metro mayors improved powers for land-value capture. These should include business-rate supplements, mayoral development corporations with compulsory-purchase powers, transport-premium charges, and fairer ways to fund roads and reduce congestion. Value can be captured fastest through better use of nearby land that the local government already owns, particularly through development, but this will rarely be sufficient to fund new transport infrastructure. Another option is to collect a Community Infrastructure Levy (CIL), or an Infrastructure Levy, on new development authorised on other land, but currently the mayor of London is the only metro mayor with that power.[_] For example, approximately 40 per cent of Crossrail was funded through taxes on London businesses and developers,[_] including business-rate supplements authorised through an act, mayoral CIL and over-station development rights. Metro mayors should be permitted to issue bonds to fund transport, secured against those revenues. In France mayors are allowed to add 1 per cent to employers’ national insurance, subject to local referendum.[_]

Give metro mayors freedom to use these new light-touch value-capture powers without national veto, so long as they do not exceed the value conferred on the landowner. This will remove the veto points at different levels that have blocked major infrastructure.

Give development corporations clear powers to deliver transport and other infrastructure, funded through value capture. Although development corporations now have compulsory-purchase powers to allow them to acquire land at existing-use value and extract value through resale, they lack clear powers to deliver transport infrastructure. For development corporations to be used effectively, those powers need to be added through primary legislation.

Create devolved powers for land readjustment. These would give mayors the authority to assemble land and provide infrastructure for transforming rural plots into urban development, as has been done in Germany. Under such schemes, the local government pools the land, builds infrastructure on some of it and then returns different segments to the landowners. This is similar to the voluntary process of community land auctions in the Levelling-Up and Regeneration Act.

Give metro mayors the power to purchase land at existing value. Although some local governments now have the power to purchase at existing value under the Levelling-Up and Regeneration Act, the powers of metro mayors to capture land value and use it for investment in infrastructure or social housing are profoundly limited. That should be improved to allow better delivery of infrastructure and social housing.

Second, at the local-planning-authority level, some incentives and powers are misaligned. To correct this, key actions include:

Encourage and facilitate planning-authority review and, where appropriate, release of green belt. National policy should also be amended, as the government has proposed, to create a new classification of “grey belt” for low-amenity sites that may be appropriate for development.

Enable more community benefits by piloting community land auctions. The government should run pilots of community land auctions for councils to raise money to build council homes and other infrastructure to drive growth and improve local amenities.[_]

Finally, there are significant opportunities to create better incentives and enhance the power of people and local communities to find opportunities to improve and add new homes.

The government should take action to:

Facilitate estate renewal through national policy. This should involve 1) creating a planning safe harbour for estate renewal in national policy that has a strong presumption in favour of proposals that have tenant support and comply with clear rules, 2) exempting renewal schemes in development from changes in planning rules and building regulations to give certainty to social landlords, and 3) creating a national centre of expertise to help social landlords with technical issues.

Help social landlords work with tenants to make better use of social housing land through estate renewal. Renewing estates will improve existing homes for residents and encourage the building of new homes through more efficient use of land. Improving the overall supply of homes will also reduce pressure in the private market, which will reduce upward pressure on the cost of land for private developers. Councils should be permitted to borrow at central-government rates, subject to Treasury approval, where there is a good business case for estate renewal. The grant system should be reviewed to enable grants to be combined and to ensure that grant financing is available over periods that match the term of renewal projects.

Let communities take the lead to set clear, predictable rules to enable development to fund more council homes. The government should quickly implement the street-vote proposal to empower communities to grow their family homes and add more homes.[_]

Set national policy to require local plans to include design codes permitting harmonious upward extensions. A similar policy has been successful in Haringey.[_] Although such upward extension will be limited in effect, it will help to alleviate housing pressures in the areas of greatest scarcity. The government has proposed amending national policy to encourage this. It should also require such upward extension to be in harmony with the original building or to conform with a local design code.[_]

Fund research into whether planning rules could be improved using mechanism design to provide the right incentives to ensure positive outcomes for the community. The social science of mechanism design has had considerable success in other fields to address collective-action problems[_] and ensure that private actors act in the best interests of society.

Reforming Markets and Incentives

While additional supply will help reduce housing costs in the medium to long term, building homes alone will not fix the UK’s housing-affordability problems.

Even a fourfold increase in housebuilding would not provide instant relief to renters. Rents are driven by the stock of homes, not by the expectation of how many homes will be built. At any plausible rate of homebuilding, rents will only decline gradually relative to household incomes.

To further alleviate the affordability problems seen in the UK housing sector and provide individuals with more freedom of choice of whether to rent or buy, the government should also prioritise addressing some of the underlying market structures.

TBI has previously set out how this can be addressed.

There are two major trends in the housing market over recent years that have made it work less efficiently and resulted in worse affordability and lower freedom of choice for individuals.

The first big change is that it has become harder for prospective first-time buyers (FTBs) to obtain the finance they need to purchase their first home.

Almost all FTBs rely on mortgage finance to buy, which means that a major barrier is ability to borrow. Access to finance has become more challenging since the financial crisis of 2008, which has been a key factor in explaining trends in home ownership since then. Home ownership has risen rapidly when lenders have been willing to take on the risk of lending to FTBs and fallen sharply when sentiment or the regulatory environment have changed. Tighter lending criteria and more realistic pricing of risk following the global financial crisis increased the deposit requirements faced by FTBs, and new regulations have limited the amount they are able to borrow. The effect of this is that at just 64.3 per cent in 2021–22, home-ownership rates in England are at levels not seen since the mid-1980s and are well below their 2003 peak of 70.9 per cent. If the rate of ownership returned to the level of the early 2000s, 1.6 million more families would now own their own homes.

The second big change is that affordability for renters has fallen because three big housing subsidies have failed to keep up with the cost of housing. First, the social-housing sector has decreased, making it more difficult for low-income families to access social housing, and social rents have increased. From 1979 to 2009–10, the social-rented sector shrank from 31 per cent to 17 per cent of the English housing stock and social rents increased from just over half to about two-thirds of market levels. As previous TBI research has shown, the effective subsidy to renters through social housing fell as a share of total day-to-day housing costs in the national accounts by 5 percentage points, although it increased in real terms. Second, rent controls in the private-rented sector were abolished. This contributed a further 5 percentage-point fall in subsidies as a share of total housing costs for renters. As a result, the UK has moved from a situation where renters paid rents that were below the levels that would have prevailed in an unrestricted market to one with a much larger market-rented sector.

Offsetting this, spending on cash benefits to support housing costs has increased as interventions that reduced headline rents have fallen away. But since 2010, housing benefit has failed to grow fast enough to keep up, further reducing the share of total housing costs covered by subsidies by 1.5 percentage points. Overall, housing subsidies fell from 16.5 per cent of total housing costs in 1979 to 11.5 per cent in 2019–20.

This trend fully explains the reduction in rental affordability for lower-income households. Had subsidy policies increased in line with housing costs, out-of-pocket housing costs for renters as a share of their incomes would have remained close to their levels in 1979.

Both of these issues can be solved to make the housing market work more effectively for people and to help alleviate the chronic affordability problems seen in the sector today.

Fixing the Mortgage Market and Supporting First-Time Buyers

Currently, various rules unnecessarily restrict home ownership and make purchasing a home harder for FTBs. Reforming this need not present a simple trade-off with financial stability. Other countries’ mortgage markets show that there are several ways to manage these risks more effectively.

Lending to FTBs inevitably involves risks. But wild swings in the cost and availability of high loan-to-value loans are unnecessary. Since the financial crisis this has resulted in growing intergenerational unfairness. Many more families have been trapped in the private-rented sector, including three times as many families with children than in the mid-2000s. Meanwhile, those fortunate enough to buy their first home have typically faced much higher interest payments than wealthier buyers with bigger deposits.

It doesn’t need to be like this. Current rules are unduly unfavourable to creditworthy renters who should be able to afford to buy their first home. Nor does it require demand subsidies. Unnecessary regulatory restrictions on mortgage lending can prevent people from buying a home and constrain house prices, as happened in the UK in the 1960s. That in turn can make some new developments unviable, reducing overall supply. Removing those barriers can both help FTBs and start to improve supply over the longer term.

The impact of this would be to reduce the unnecessary barriers faced by renters with good credit who do not have the funds for a deposit to buy a home, either from their own means or with family help.

The government should:

Tackle credit risk by removing the regulatory barriers to greater use of mortgage insurance. This could involve encouraging the development of a private market or making changes to the existing state Mortgage Guarantee Scheme. International experience shows that this approach is effective at expanding access to low-deposit mortgages and reducing costs for FTBs.

Address interest-rate risk by reducing regulatory constraints on long-term fixed-rate mortgages. Such mortgages involve much lower risk for consumers because they cannot suffer from an interest-rate shock. As a result, these mortgages should be partly or wholly excluded from the regulatory limit on the number of mortgages with a loan-to-income ratio higher than 4.5. In addition, regulators should make it clear that financial advisors should feel free to recommend such mortgages and perhaps encourage them to do so if this is the only way a client can purchase a home. The advantage to FTBs would be that, with blunt affordability tests out of the way, they could potentially borrow a higher loan-to-income multiple. This would give borrowers more flexibility and potentially help to diversify mortgage funding to investors with longer-term perspectives.

Review the Right to Buy system so that the price paid by tenants is fair. The price should take into account the value of the residual freehold or leasehold interest that they are buying and the value of the tenant’s existing secure tenancy.

Housing Subsidies

Alleviating affordability problems will also require reversing some of the cuts to housing subsidies that have been made over the past half-century. But policymakers should also consider how to most effectively use different types of subsidy – in particular the split between the provision of social housing and cash benefits. This requires intervention at the right point and in the right way.

Introducing schemes like rent control, for instance, can cause serious issues.[_] These include new tenants being unable to find a home to rent, long waiting lists for homes, landlords allowing properties to deteriorate because more investment will not deliver an attractive return, reduction in labour mobility should renters become tied to a particular property and a reduction in available private-rented stock as landlords sell. If the average buyer of a previously rented home occupies more space per person in that home than they did as a renter, that will mean that the average remaining space per renter will decrease. This increases the shortage for the remaining renters, which will further drive up rents. Care must be taken not to harm renters through poorly designed reform. Rent controls have had devastating effects in many rental markets where they have been tried.

Social housing offers more-secure tenancies and stronger financial work incentives for tenants than cash support for private rentals. There are several groups for whom these considerations are particularly important. There are currently 1.9 million pensioners, lower-income families with children and people with a disability living in the private-rented sector for whom more-stable housing tenure is a priority. Some of these households could be helped into home ownership with appropriate policy reforms, but for others this will not be an option. Additional social housing would be most helpful for these groups. An additional 700,000 social properties would allow the level of social renting among lower-income families with children to return to its 1979 level and the share of lower-income working-age disabled people living in private-rented accommodation to be reduced to below 10 per cent.

Building more social housing will be a core lever to address this. But in addition, the government should take steps to address the needs of current tenants. The government should:

Fund a study of options for, and potential economic and social benefits of, making council tenancies more flexible for tenants. This could be done by extending the existing market for swaps of social homes or by other means.[_] Although social housing has many advantages for tenants, it can make them less mobile; it may be possible to remove or reduce this barrier at no fiscal cost.

Give estate residents the power to choose by qualified majority to replace their social landlord with another one.[_] Such an effort could draw on the success of school academies, introduced in the 2000s to give tenants control to get better outcomes. It should help address the problem of underperforming housing associations and result in growth for the social landlords who best serve their tenants.

However, the social sector has disadvantages for tenants too, as they have little choice as to the location or type of property they are allocated. This may prevent them from taking up employment opportunities outside their local area, hampering productivity in the economy. For other groups such as the temporarily poor or working-age people without children, these will be the most important considerations. Providing cash housing benefits should be the primary form of support for these types of households. If the affordability of private-rented housing is to be improved, it will be necessary to make a positive case for the role of housing benefits, rather than a cost to be minimised.

Housing-benefit rates should be set at a level that allows low-income renters to afford a range of properties in their local area given prevailing rent levels. Local Housing Allowance rates should therefore continue to be linked to the 30th percentile of local rents rather than being frozen in cash terms, as was the intention under the previous government’s plans. To improve the experience of renting in the private sector, the new government should also reintroduce the Renters Reform Bill that fell at the end of the last parliamentary session, which contained reforms that would improve security for tenants.[_]

Chapter 5

Britain’s housing problems have been going on for long enough. There is now an opportunity to resolve them. Through an ambitious plan to build new homes, in the right locations and of the right tenures, Britain could finally break out of a period of timidity and low ambition. If we are prepared to take very bold action, the rate of homebuilding could break through the currently unfulfilled previous targets and well beyond.

A better overall package of support on housing will bring benefits throughout the country, bringing people closer to good jobs, creating new economic opportunities and improving quality of life. There are few other policy interventions that could achieve these outcomes.

Such a plan will require radical action, but it is achievable. UK housing and planning policy can become a platform for rapid, high-quality delivery in a way that is welcomed by communities. It should unleash innovation in the sector and utilise the power of AI to drive efficiencies and better outcomes.

There is an immense opportunity to deliver better homes, jobs and public services if the new government is willing to continue to take thoughtful steps for ambitious change. Business as usual will not do the job – action will.